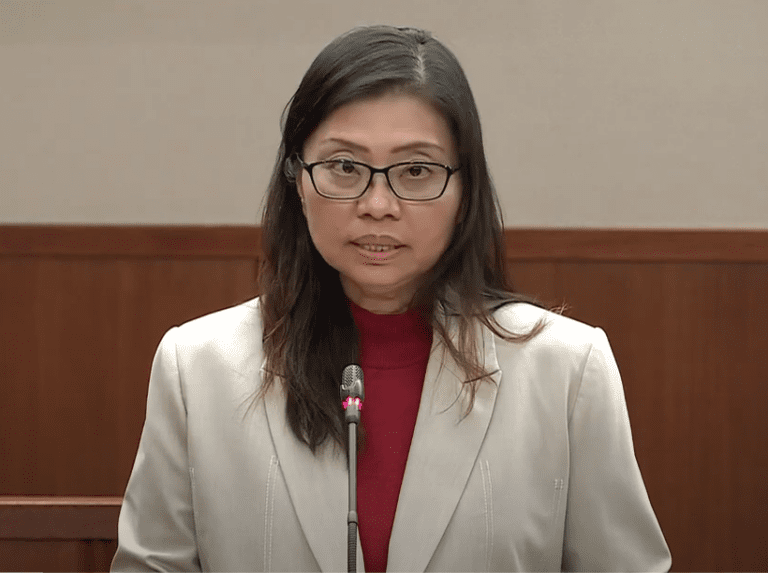

In her address in Parliament on the 26 February, NCMP Hazel Poa questioned Budget 2025 for relying on one-off vouchers instead of long-term solutions. She pushed for structural changes like more affordable HDB pricing, lower GST, fairer corporate taxes, and fixed hawker rents. She also called for more public holidays and a “right to disconnect” law while supporting the Budget for its short-term help.

Mr Speaker Sir,

Cost of Living

Budget 2025 continues to help Singaporeans deal with rising cost of living through vouchers. While many Singaporeans will welcome the $600 or $800 SG60 Vouchers, and additional $800 CDC Vouchers, they are not enough to help Singaporeans in the long-term, or solve Singapore’s structural economic issues. These vouchers and credits are ad hoc benefits given out by the Government. They are dependent on the availability of surplus collection of tax revenues and at the discretion of the government of the day.

Older Singaporeans may remember the $2.6 billion Progress Package in 2006 and the $3.2 billion Grow and Share Package in 2011, before the general elections in those years. We have gone from Growth Dividends every few years to CDC Vouchers seemingly every year. It would be unhealthy if Singaporeans become increasingly reliant on these ad hoc gifts to manage rising costs.

In contrast, PSP has proposed a package of systemic measures to reduce cost of living. Our policies are structural and not ad hoc. They are intended to empower Singaporeans and allow Singaporeans to achieve as much financial independence as possible on their own, without being dependent on ad-hoc handouts from the Government.

PSP’s policy proposals are also based on a better balance of social and economic considerations, unlike the PAP’s current policies, which are too heavy on economic considerations.

Let me provide some examples to explain.

The PAP’s current policy of transferring the full market cost of land used for HDB flats into the reserves is based on economic considerations. But this places a heavy burden on Singaporeans because the land cost must be recovered from Singaporeans through the cost of flats or additional taxes.

PSP’s proposed Affordable Homes Scheme will price new HDB flats to recover only the construction cost but not the land cost. This places a greater emphasis on social considerations of keeping housing more affordable for Singaporeans. By doing this, we are also empowering Singaporeans to have the financial resources to achieve their dreams, instead of chaining them to 30-year mortgages that are increasingly unaffordable.

My colleague, Mr Leong Mun Wai, will speak more on housing later.

Another example is hawker rents. The Government’s policy of setting rent based on the highest bid is purely based on economic considerations. But this policy has consequences on food prices.

That is why PSP has advocated for a fixed rental system, of $500 per month or 3% of the hawker’s gross turnover per month. This places more weight on social considerations of keeping food prices lower for Singaporeans. Our proposal is a structural change to lower cost of living. In contrast, Budget 2025 provides a one-time rental support of $600.

Finally, the current policy of awarding COEs to the highest bidder is also purely based on economic considerations. PSP has proposed a new system that incorporates needs factors with bidding, so that those who have greater needs for a car will have a better chance of obtaining one and can do so at a lower cost. This, again, better balances social and economic considerations.

Another contributor to higher cost of living is the raising of GST from 7% to 9% over the last 2 years, at a time when Singaporeans were hit with high inflation.

PSP has long proposed to reduce GST from 9% to 7%. We believe that any additional revenue required for higher social expenditures can be raised from reforming the corporate income tax.

We have stated before, in my Budget speech in 2023, that under our current corporate income tax regime, companies with the highest profits actually pay the lowest percentage of their profits in corporate income tax. This is inequitable.

The global agreement on a minimum effective tax rate for large multinational enterprises has compelled us to adjust the taxes on the largest companies. We hope that it will not be affected by the US President’s Executive Order that it has no force and effect in the US. Even under this agreement, many companies are not covered, because it applies only to very large companies with a group revenue of at least 750 million euros annually. Adjustments will still need to be made to make our corporate tax regime more progressive and equitable.

Corporate income tax reform would allow us to reduce GST, which is a regressive tax, even though the Government says that the GST Voucher scheme makes it not regressive.

Now, the Government has said on many occasions that the tax revenues from different sources all go into the same Consolidated Fund, from which all expenditures are then paid for. We do not designate specific revenue streams for specific purposes.

So there is nothing linking the GST to the GST Voucher scheme. The vouchers can still be paid for even if we raise the additional revenue for it by increasing corporate income tax on the most profitable companies, instead of by raising GST. This will make our tax system even more progressive.

The Government’s $6.4bn surplus for Financial Year 2024/25 and the expected $6.8bn surplus for the next financial year further underlines that there was no necessity to raise GST from 7% to 9% in 2023 and 2024. Let us also not forget that larger surpluses that go into the reserves mean bigger cost burdens on taxpayers when the Government collects more than is needed to spend on public programmes.

Family

Finally, I wish to touch on the Large Families Scheme introduced to support married couples who have, or aspire to have, three or more children. The Government has said that this scheme is not intended to incentivise more couples to have three or more children, and drawing from past experience when large baby bonuses have failed to raise the Total Fertility Rate, PSP also believes that it will not.

What we need are structural changes to incentivize employers to be more family-friendly, and to create better work-life balance so that Singaporeans have more time to find life partners and raise children. What we need is to move the needle for those who want children but do not currently feel ready or that they have sufficient resources to have children. PSP has previously urged the Government to introduce incentives to family-friendly employers. We will pursue this further during COS.

Today, we would like to make two new proposals to improve Singaporeans’ work-life balance, by increasing the number of public holidays and enacting the right of workers to disconnect.

The number of public holidays in Singapore has remained unchanged since 1968, when the Government reduced the number of public holidays from 16 to 11 to improve Singapore’s competitiveness. Since then, Singaporeans have worked hard and our nation has prospered. Now, we face new problems such as a lack of work-life balance and overwork that are impacting family formation.

PSP proposes to increase the number of public holidays from 11 to 14, with one additional holiday for each of the three major races in Singapore. The exact holidays should be determined in consultation with each community, but we can consider the possibilities of observing Chinese New Year’s Eve, the second day of Hari Raya Puasa, and Thaipusam as public holidays. With the increased 14 days of public holiday, it will still be in line with the norms in the region and globally.

Next, PSP would like to lend its support for “right to disconnect” legislation to be progressively implemented in Singapore. Workers in Singapore already work very long hours compared to others around the world, but this may not even include time spent at home responding to work-related texts and emails, which prevents workers from spending quality time with their families. We can first introduce the “right to disconnect” legislation for employees who are on paid leave, and eventually extend to the “right to disconnect” between 7PM and 7AM or outside the normal working hours of the employee. These would allow employers and employees to adjust to these new workplace norms.

We can also do more to create work environments that are friendly to parents, especially single parents, and improve childcare arrangements. Mr Leong Mun Wai will speak more on this during his speech.

These changes also need to be coupled with changes to the education system to reduce the stress and competition for students and parents. I will speak more on this during the COS debates.

Mr Speaker, Mandarin please.

议长先生,今年的财政预算案继续通过购物券来帮助新加坡人应付上涨的生活成本。虽然这些购物券的确能在短期内提供支援,但无法提供长期的帮助,也无法解决结构性的高成本问题。如果新加坡人越来越依赖这些临时福利,那不是一个健康的趋势。购物券不是长久之策。总理之前申明预算案将帮助国人应付生活成本,让人产生了期望,却是雷声大,雨点小。

相比之下,前进党提出了一系列系结构性的措施来降低成本。我们的政策不单单考量经济因素, 也同时慎重考虑社会因素。 这些政策的宗旨在于尽可能为新加坡人实现经济独立的能力,而不是对政府的临时补贴产生依赖。

例如,在政府组屋方面,前进党提出了“安居乐”计划,让新组屋的价格只收取建造成本,而不包括地价。和行动党的政策相比,我们更顾虑新加坡人是否能负担得起他们的组屋。“安居乐”计划也会让国人拥有更多财务资源以实现自己的梦想,而不是让30 年的房贷成为国人人生的枷锁。

前进党也提出了降低小贩摊位的租金来降低小贩中心的食物价格, 将消费税降回7%,以及由政府支付保健保险的费用来减轻国人在医药费上的负担。这些都是基于社会考量而提出的长期措施,并不是一次性的。

我们也需要更多结构性的改变,来为国人打造一个更亲家庭的环境。为让国人能更好的平衡生活与工作,前进党提议立法实现“离线权”,让国人在休假或正常工作时间之外,有权不回复与工作相关的短信和电子邮件。前进党也提议,将11天公共假期,增加到14天。政府可与各大种族商讨具体增设哪些公共假期,但是前进党认为我们可以考虑增设大年除夕、开斋节翌日、和大宝森节。

Conclusion

Mr Speaker Sir,

PSP believes that our cost-of-living issues should be addressed through structural policy changes, of which we have proposed several, rather than the band-aid approach of ad-hoc gifts and handouts.

Notwithstanding our reservations, PSP will still support the Budget because short-term assistance is necessary for Singaporeans to cope with the rising cost of living, until structural changes are implemented.