PUBLIC HOUSING POLICIES: That this House calls upon the Government to review its public housing policies in order to deliver affordable and accessible HDB flats to all Singaporeans, strengthen the owner-occupation intent of public housing, protect retirement adequacy and keep public housing inclusive for every Singaporean of each generation.

Mr Speaker Sir,

The Progress Singapore Party, PSP believes that our public housing policy needs a reset and hence we have identified the areas where we need to review, in our motion. The Government’s motion on the other hand seems to suggest that there is no need to review its current housing policies. PSP will state our position clearly. I hope the Government will also state clearly why it thinks that public housing is still affordable and accessible today? And against who is it protecting the interest of current and future generations of Singaporeans?

It is clear that the Government is not confident that Singaporeans believe in its housing policies since the Government has been running extensive advertisements in the mainstream media to illustrate the affordability of BTO flats. If HDB flats are truly affordable and accessible, Singaporeans will know it, there is no need to explain it.

If Singaporeans are not satisfied, the Government should be proactively reviewing its policies and telling Singaporeans what corrective policy actions it will be taking to resolve housing problems. There is no need for advertisements. Singaporeans should be treated like citizens, not consumers.

Mr Speaker, public housing was one of the greatest achievements of our nation under the government of the late Mr Lee Kuan Yew. During the early years of independence, when land cost was not built into the price of an HDB flat, the Government was able to provide a roof over the heads of all Singaporeans who needed it, in a timely manner and at affordable prices.

The security of a stable dwelling liberated Singaporeans in that generation and provided them with the energy to build a new nation and change Singapore for the better.

However, the situation changed drastically in the 1990s when the Government started to treat the HDB flat as an “appreciating asset”. In 1995, then Prime Minister Goh Chok Tong told Singaporeans that we were embarking on “a new phase where the government increases your asset value through the Asset Enhancement Programme”.

Since 1990, the HDB resale price index has increased by seven times as a result of the asset-enhancement policies of the Government, but the median monthly household income has only increased four times.

As a result, the heavy burden of homeownership today robs young Singaporeans of the financial security they need to be enterprising risk-takers and build Singapore into a competitive information economy.

To address that, the Progress Singapore Party or PSP’s main objective for public housing is to ensure Singaporeans have both affordable housing and retirement adequacy. Every Singaporean should be able to have an HDB flat and their Basic Retirement Sum in their CPF without having to downgrade their HDB flat or sell their lease to the Government in retirement. By doing this, every Singaporean can be free to realize their full potential in life, and we have the resources to do this.

PSP’s policies are also aimed at giving more choices to Singaporeans. While ensuring affordability for owner-occupiers, we will aim to maintain a buoyant resale market for Singaporeans who want to monetise their HDB flat and upgrade to private property. And while we encourage owner-occupation, we will also offer more rental flats for Singaporeans at different life stages and circumstances.

With all this in mind, I will walk the Members through Singaporeans’ concerns about public housing before introducing the PSP’s policy recommendations.

Singaporeans’ Concerns

The first concern is that affordability has little meaning without accessibility. The Government keeps harping on the affordability of BTO flats but they are in short supply. With the waiting times for BTO flats stretching to between 5 and 7 years, compared to between 18 and 24 months during the 1980s, many first-time buyers have no choice but to buy a resale flat. Hence overall affordability will depend on the prices of both the BTO and resale flats.

Today, resale flats, especially the newer ones can be as much as 30% higher than BTO prices. Resale prices have outpaced wage growth by a large margin over the last three decades. Since 1990, the HDB resale price index has increased seven times but the median monthly household income has increased only four times. Singapore has witnessed a streak of 11 consecutive quarters or nearly 3 years of price increases in the resale market. Hundreds of resale flats have been transacted above a million dollar with hundreds more being offered on the market.

BTO prices have been rising too. Even though the Government has maintained that BTO prices are not linked to resale prices, SMS Sim Ann acknowledged in December last year that the windfall gain from a BTO flat cannot be too large, otherwise it will be unfair to buyers who were unable to secure a BTO flat.

Indirectly, I take this to mean that while the Government can temporarily slow down the increase in BTO prices when resale prices are surging, like today, BTO prices must eventually keep up with the increase in resale prices over the long term. Not surprisingly, many in the property market are predicting that the $1 million BTO flat will appear soon.

The second concern is even BTO prices deplete Singaporeans’ CPF balances. The Government says BTO is affordable because most homebuyers need not pay cash to service their monthly mortgages, which can be covered by their CPF savings. However, this comes at the cost of depleting their CPF savings. This is backed up by the latest data released by the Government in January in response to Assoc. Prof Jamus Lim’s question, which shows for those at the bottom 40% income bracket, the median percentage of monthly CPF contributions used to service housing loans is more than 70%. For the bottom 20% income bracket, it is more than 99%.

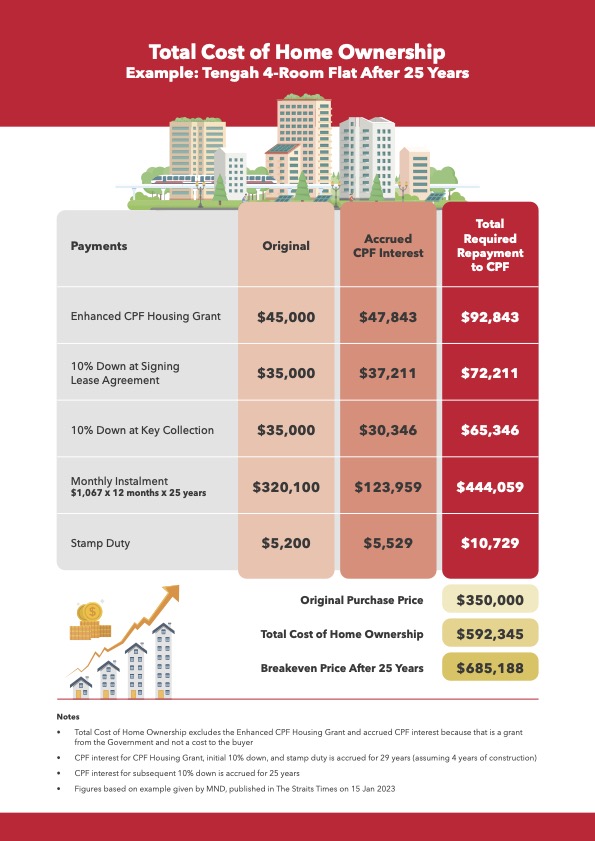

With your permission, Mr Speaker, may I ask the Clerks to distribute a table to show how the purchase of a BTO flat can deplete the buyer’s CPF account over 25 years. Members may also access the handout through the SGParl MP mobile app. The data in the table is based on an HDB’s advertisement in the Straits Times on January 15, to show BTO flats are still affordable. However, the advertisement does not show the total cost of homeownership, which is shown in my table. (Please refer to table below)

A new 4-room BTO flat at Tengah that initially costs $350,000 will actually cost the buyer $592,000 in CPF savings after 25 years of principal repayment and financing costs. This is the total cost of home ownership to the buyer, and it is 70% higher than the purchase price. The drain on CPF savings will be even larger for those who purchase resale flats, and also for future generations as BTO prices continue to follow the rise in resale prices.

Affordability is not about whether the housing loan can be serviced on a month-to-month basis by CPF savings or not, but by looking at the effect of the total cost of home ownership on the CPF retirement account. Currently, high HDB flat prices caused by rising land cost are raiding the CPF savings of Singaporeans while HDB pays $3 to 4 billion in land cost into the Past Reserves each year.

The third concern is lease decay, which has started to threaten the retirement adequacy of Singaporeans. Even older Singaporeans who have bought their HDB flats at lower prices are exposed to the problems of the current public housing policies and their problem is lease decay.

We did not need to worry about lease decay in the past when all flats were young and the Government did not mention it until in 2017. However, by 2030, almost half of the HDB flats will be more than 50 years old and the prices of these HDB flats are expected to decline sharply accordingly to empirical valuation models. In the local context, limitations on loans and CPF usage will start to affect the prices of flats above 40 years of age, which coincides with the time when retirees want to monetise their flats.

The Government, which has promoted the HDB flat as a store of value for retirement, has previously tried to reassure Singaporeans over the lease decay problem with policies such as the Voluntary Early Redevelopment Scheme (VERS).

However, as I have said during my Adjournment Motion last month, the Ang Mo Kio SERS incident has shown that if the Government uses the same compensation formula as SERS for the older flats in VERS, flat owners will have to put up a significant cash outlay to buy a replacement flat which they can hardly afford. It appears that VERS is not a credible solution for the lease decay issue unless the Government provides further details to prove otherwise.

Without the information, Singaporeans will continue to form ungrounded expectations over VERS, and this will disadvantage Singaporeans especially the lower income segments who most need to monetize their flats to supplement their retirement income. Potential young buyers also want to know whether they can get their CPF savings and accrued interest back when they use them to buy older HDB flats.

The fourth concern is the shortage of BTO flats and high resale prices have impacted the total fertility rate. I have highlighted this issue since my first Committee of Supply debate in 2021. The problem has worsened since then and currently close to 100,000 young couples are waiting for their BTO flats, some more than 5 years already.

Apart from the new longer term policies we are discussing today, the Government should take more urgent short-term measures to help young couples with their housing problems instead of relying on limited avenues of help like the Priority Parenthood Housing Scheme. The policy failure today will have dire consequences on our population structure and economic performance in the future, as young couples will have less incentive to have children due to financial challenges. My colleague, Hazel Poa will touch more on this later.

To address the concerns mentioned above, PSP proposes two policies – the Affordable Homes Scheme and the Millennial Apartments Scheme – with the aim to reset our public housing system to improve affordability and accessibility, strengthen the owner-occupation intent, protect retirement adequacy, and reduce social inequality, all of which are embodied in the motion statement today. I invite Singaporeans to judge the merits of these policies for themselves.

The Affordable Homes Scheme (安居乐计划)

Our first proposal is the “Affordable Homes Scheme”, which is based on a deferred land cost idea first proposed by Dr Tan Meng Wah in 2013 when he was a research fellow with the Institute of Policy Studies at NUS. It goes to show that there are many good ideas in the public domain provided the Government remains open to them.

This Affordable Homes Scheme is designed to allow a Singaporean to buy a new flat at a “user price” which is equal to the construction cost plus a notional location premium. If a Singaporean stays in the same flat his entire life, he will only pay the user price. This user-price concept was first suggested by Mr Yeoh Lam Keong, the former Chief Economist of GIC.

At the point of purchase, the “land cost” for the flat will be made known and recorded with the HDB. If the Singaporean sells his flat in the resale market after the Minimum Occupation Period, he will have to pay this land cost with accrued interest based on historical mortgage rates to the Past Reserves before pocketing the net profit, hence he ends up paying the full price of the flat.

Let me explain the principle behind the Affordable Homes Scheme. We believe owner-occupied public housing is a public good that should be treated as a form of essential public infrastructure, like schools and hospitals, where land costs are not charged because it is treated as State Land. We believe that land used for owner-occupied HDB flats should be treated in the same way as schools and hospitals.

Hence as long as Singaporeans are leasing HDB flats for owner-occupation, they should not have to pay for the land cost. They should only pay the land cost when they take the HDB flats to be an investment and sell it for a profit. The Affordable Homes Scheme takes care of the Singaporeans without hurting the Past Reserves.

In the same example of the Tengah BTO flat, whereas the full price is $350,000, the Singaporean buyer will only pay the user price of about $140,000 at the time of the purchase under the Affordable Homes Scheme. The balance of $210,000 in land cost will be paid later into the Past Reserve when the flat is sold after the Minimum Occupation Period.

At the lower user price, the buyer will have about $323,000 more in his CPF account after servicing the housing loan compared to the current BTO pricing system. The buyer will have enough CPF savings to satisfy his Basic Retirement Sum.

Under the Affordable Homes Scheme, HDB will return to its primary objective of providing affordable homes for Singaporeans while CPF will return to its primary objective of providing savings for retirement. One policy, one objective. Singaporeans will no longer have to depend on rising property prices to provide for their retirement. Every Singaporean will have their Basic Retirement Sum without having to sell their flat or pledge it to the Government.

It is also a more equitable way of allocating HDB flats. By lowering the prices of new flats, lower income Singaporeans will be able to afford flats in better locations. Flats in prime locations will not become enclaves for the upper middle class only.

Despite all the above-mentioned advantages, the Affordable Homes Scheme will not have a major impact on the nation’s fiscal position and reserve accumulation. Currently, about two-thirds of HDB flats are resold after the Minimum Occupation Period. Even if this proportion drops with the introduction of the Affordable Homes Scheme due to the strengthening of the owner-occupation intent, the Government will still be able to recover a substantial part of the deferred land cost.

Anyway, it is narrow-minded to see the cost of this Scheme as a raid on the reserves because affordable housing is an investment in our people for the benefit of current as well as future generations. And we believe that the interests of current and future generations are not mutually exclusive.

If the current generations needs the resources badly, there should be no question of that compromising the interests of the future generation. The best inheritance that we can pass on to our future generation is a current generation that has done well.

The Affordable Homes Scheme is aimed at moderating the resale prices but we are not expecting a precipitous fall in the resale prices because of several reasons.

Firstly, the backlog of housing demand will continue to persist and provide support for the resale market in the next few years.

Secondly, the market may look further into the horizon and realize that the supply of resale flats will be lower in the future as the owner-occupation intent strengthens.

Thirdly, new sellers will not sell their flats unless the price is high enough for them earn a profit after paying off the deferred land costs. This will reduce the available supply of resale flats and support resale flat prices.

Finally, if the Government provides more certainty on the future of existing HDB flats by releasing more details on VERS, that will further support resale prices and help the market transition to the Affordable Homes Scheme. This is a good opportunity to resolve both the affordability and lease decay problems at the same time.

Millennial Apartments Scheme (千禧房计划)

Our second proposal is the Millennial Apartments Scheme. The idea is for the Government to keep a large stock of quality rental flats to provide young Singaporeans who desire more space and more independent living with more housing choices. Again this idea has surfaced from the public domain as a popular demand by the younger generation, who desire a greater variety of housing options.

We propose that the main supply of the Millennial Apartments will come from prime locations near the Central Business District. These locations are currently highly sought after by buyers driven by the profit motive but it is more equitable not to sell all the HDB flats in prime locations but keep a larger portion of them for rental so that a broader range of Singaporeans can access these flats.

The Millennial Apartments will be smaller and quality flats on affordable leases of 2 to 5 years for young families or groups of singles. These apartments should be attractive because they are close to the workplace, good amenities for families and even vibrant nightlife spots.

Concentrating young Singaporeans together will allow those who are single to have more opportunities to socialise and perhaps marry, while those who are already married will have more time for their families because they live near their workplaces.

HDB can also develop a network of shops around these Millennial Apartments to allow a more diverse range of business to operate near the Central Business District at lower rents. With these businesses and a vibrant young population, our Central Business District can become economically productive day and night.

Conclusion

Mr Speaker, our public housing has become a national malaise which robs young Singaporeans of the financial security they need to be enterprising risk-takers and build Singapore into a competitive information economy, and the old Singaporeans of their well- deserved retirement.

While the Government does not acknowledge any problems, the PSP saw the urgent need to reset the public housing policy and has proposed the “Affordable Homes Scheme” and the “Millennial Apartments Scheme” as solutions to our public housing malaise.

With the two schemes, Singaporeans can look forward to a better future where:

- Owner-occupied public housing is truly affordable as land cost is waived.

- They can have enough to retire without having to downgrade or sell back their lease to the Government.

- They have more choices to choose what best suits their life plans and aspiration – to buy or to rent, to be an HDB occupier or an investor and others.

- The resale market remains buoyant although less speculative.

It is important to reiterate that the two schemes will not raid the reserves no matter what the Government may say. We only need the Government to make up its mind and we can execute the reset as swiftly as we have tackled the Covid-19 pandemic.

On this Valentine’s Day, the best Valentine’s Day present that this Government can give a young Singaporean couple is an affordable and accessible HDB flat.

Sir, I beg to move the motion.